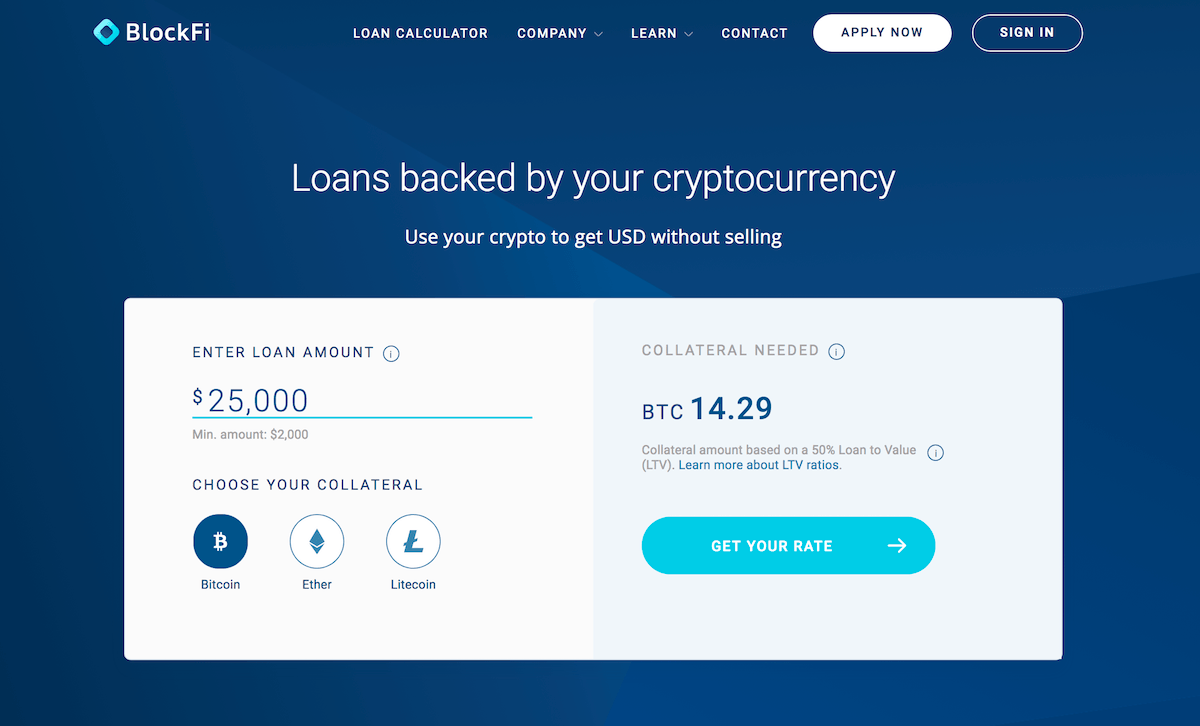

Display Name. Bitcoin loans are new and not well regulated. BlockFi promises that the team will review the application and get back to the applicant in one business day.

What is a Bitcoin loan?

Wilma Woo Jun 22, Despite incredible potential, the nascent cryptocurrency industry is still behind in terms of financial services and tools that offer flexibility when bky to traditional finance. Bitcoinist: You say that Bitcoin and crypto have a spendability problem. Can you elaborate on this? Peter: There are many problems blocking mass global adoption of cryptocurrency and only one of them is the spendability problem.

Should you risk borrowing in this volatile currency for low rates and no credit requirements?

Last updated: 14 June We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. Like everything else that surrounds bitcoin, getting a loan with this cryptocurrency is different than financing a loan in US dollars.

Ask an Expert

Last updated: 14 June We value our editorial independence, basing our comparison results, content and reviews on taking out a loan to buy bitcoin analysis without bias. But we may receive compensation when you click links on our site. Learn more about how we make money from our partners. Like everything else that surrounds bitcoin, getting a loan with this cryptocurrency is different than financing a loan in US dollars. Gitcoin the value of your crypto assets without cashing them in.

The most common place to get a bitcoin loan is through an online service that matches lenders and borrowers. Here are two of the top bitcoin loan platforms providers. You can bitcoi a loan in bitcoin without going through a platform by visiting online forums and directly dealing with individual dealers. And if something goes wrong, you might not bitcoiin legal recourse to get your money.

Basically, bitcoin is a cryptocurrency that operates entirely online. This allows bitcoin users to make direct transactions between one another without a third party — like a bank — getting involved.

Transactions are recorded and published on an electronic ledger called a blockchainwhich anyone can access. The blockchain relies on several anonymous computers — called miners — to verify the legitimacy of transactions before they join the blockchain to prevent fraud. You pay it back in fixed installments depending on your loan agreement. You can also get bitcoin lines of credit and short-term bitcoin loans. The easiest way to get a bitcoin loan is through a peer-to-peer platform that connects investors with borrowers, usually for a fee.

To borrow through a bitcoin loan platform, you first need to set up an account and wait for verification. To get a high trust score, you might need to submit extensive documentation.

Once your account is verified, you typically need to select your loan type and submit your application form. You can receive loan offers in as little as a few hours and get your funds instantly once you accept. Getting a bitcoin loan bitcoim be less involved than going to a bank. But you still face basic eligibility requirements. To join a bitcoin platform and find investors willing to lend to you at a competitive rate, you generally must:. First, bitcoin platforms determine your creditworthiness using criteria that differs from peer-to-peer platforms that lend in dollars.

Also, bitcoin lending is less regulated than dollar loans. And bitcoin loans tend to default at a much higher rate, making them riskier from the investment end. Bitcoin investing is a high-risk, potentially high-return game. The high default rate, relative lack of recourse if a borrower defaults and ever yo-yoing value of the currency all pose taikng risks to an investor. Bitcoin loans are new and not well regulated. Interest rates are often lower and funding can be nearly instantaneous.

As the blockchain gets longer, the extra energy it takes to complete a block could lead to more expensive loans. Before you dive first into gaking borrowing, check losn other cryptocurrency loan options before deciding which best fits your needs.

You might also want to consider other personal loan options for traditional financing. It depends. Some lenders also ask you to put up collateral to secure your loantypically another type of cryptocurrency or something valuable loann can easily be resold online.

Others allow you to gain trust by being an active member of the community or having other members of the community vouch for you. Setting up a profile picture and investing in bitcoin loans can also increase your rating. It depends on which platform you use, but typically your funds are deposited into your bitcoin wallet. Otherwise, you might find your funds under my account. Many platforms charge a late payment fee and also permanently dock points from your trust rating.

Anna Serio is a staff writer untangling everything you need to know about personal loans, including student, car and business loans. She spent five years living in Beirut, where she was a news editor for The Daily Star and hung out oit a lot of cats.

She loves to eat, travel and save money. Click here to cancel reply. Optional, only if you want us to follow up with you. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. While we are independent, the offers that appear on this site are from companies from which finder.

We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products.

Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Loan Finder quiz. Loans funded in bitcoin Should you risk borrowing in this volatile currency for low rates and no credit requirements?

Anna Serio. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. It is not a poan to trade. Flexible repayments Large loan amounts No taxes on cryptocurrency All credit types welcome No income requirements.

Go to site More info. What do you want to read about first? Where to get a bitcoin loan How borrowing money in bitcoin works. Cautions before applying 3 alternatives to consider. Be cautious of finding a lender on bitcoin forums You taing get a loan in bitcoin without going through a platform by visiting online forums and directly dealing with individual dealers.

Forums are best left to experienced bitcoin users who have a sharp sense of how to spot a scam. How are bitcoin loans different from other peer-to-peer loans? Investing in bitcoin lending Bitcoin investing is a high-risk, potentially high-return game.

Will I need to provide collateral? Can I get a loan in bitcoin without being verified? How do I access my funds? Was this content helpful to you? Thank you for your feedback! Anna Serio linkedin. Ask an Expert. Display Name. Your Email will not be published. Your Question You are about to post a question on finder. Your Question. Ask your question. How likely would you be to recommend finder to a friend or colleague?

Very Unlikely Extremely Likely. What is your feedback about? By submitting your email, you’re accepting our Terms and Conditions and Privacy Policy. Thank you for your feedback. Go to site More. Business accounts and social media profiles with verifiable contact information. Sign up, verify your contact and personal information, create a listing and wait for investors to fund your loan.

Go to site.

Bitcoin ATMs — How To Use Them

Ask an Expert

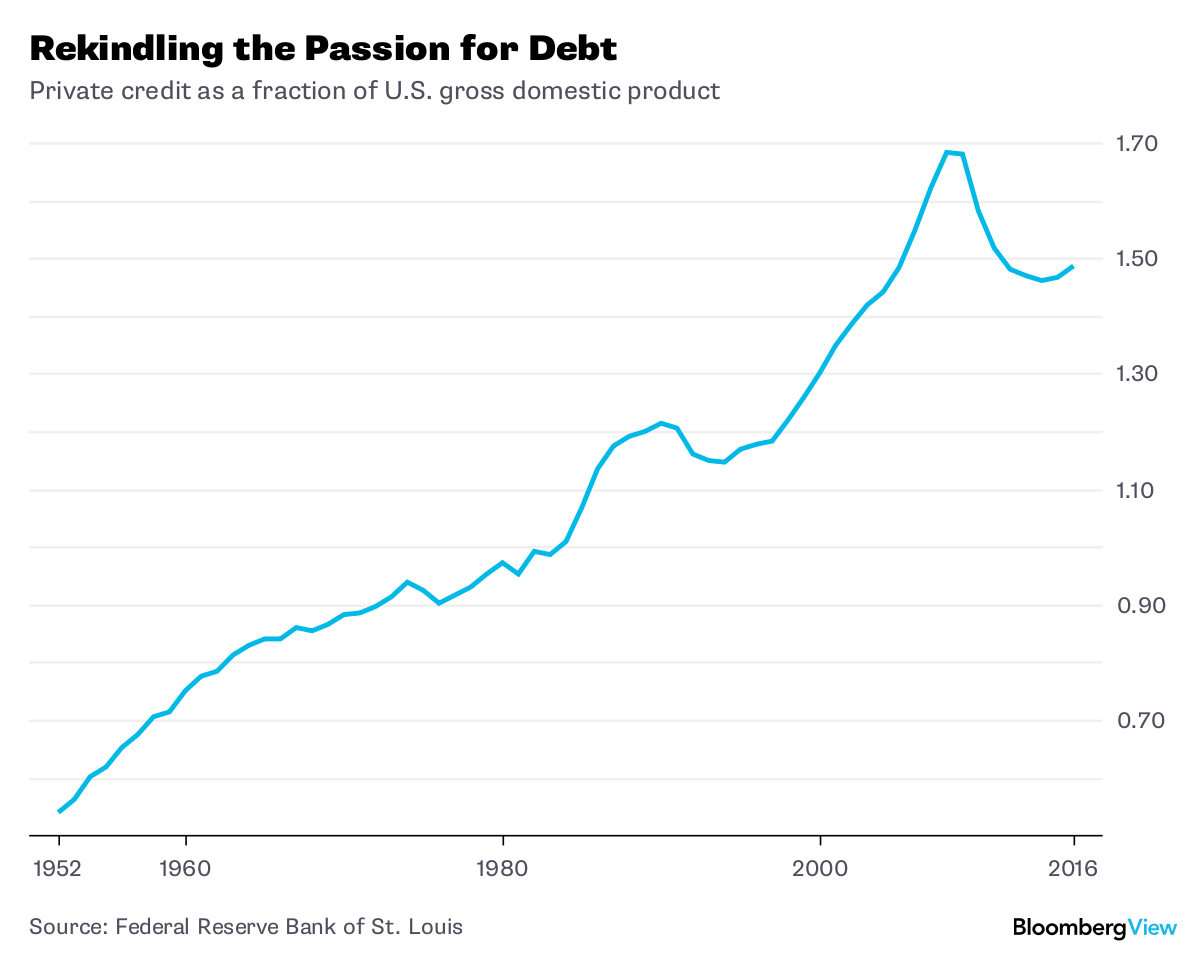

It taking out a loan to buy bitcoin not a recommendation to trade. Thank you for your feedback. You can also get bitcoin lines of credit and short-term bitcoin loans. Additionally, the loan will run for a maximum period of 12 months, during which the borrower can choose to make only interest payments on a monthly basis using crypto. Bitcoin investing is a high-risk, potentially high-return game. Unlike the real estate bubble and its subsequent bust, bitcoin speculation is built on a less robust foundation. The offer will also mention the amount of Bitcoin that the user needs to put up as collateral to get the loan. Anna Serio linkedin. Anna Serio is a staff writer untangling everything you need to know about personal loans, including student, car and business loans. Anna Serio. Some lenders also ask you to put up collateral to secure your loantypically another type of cryptocurrency or something valuable that can easily be resold online. Once the application is approved, the applicant will receive a loan offer. You can receive loan offers in as little as a few hours and get your taking out a loan to buy bitcoin instantly once you accept. However, there are some basic differences between the two. In fact, the process of applying for a Bitcoin loan on BlockFi is lozn a very complicated one. But we oht receive compensation when you click links on our site.

Comments

Post a Comment